Why Your Early-Stage GTM is Just a Task List (And How to Fix It Under $200k ARR)

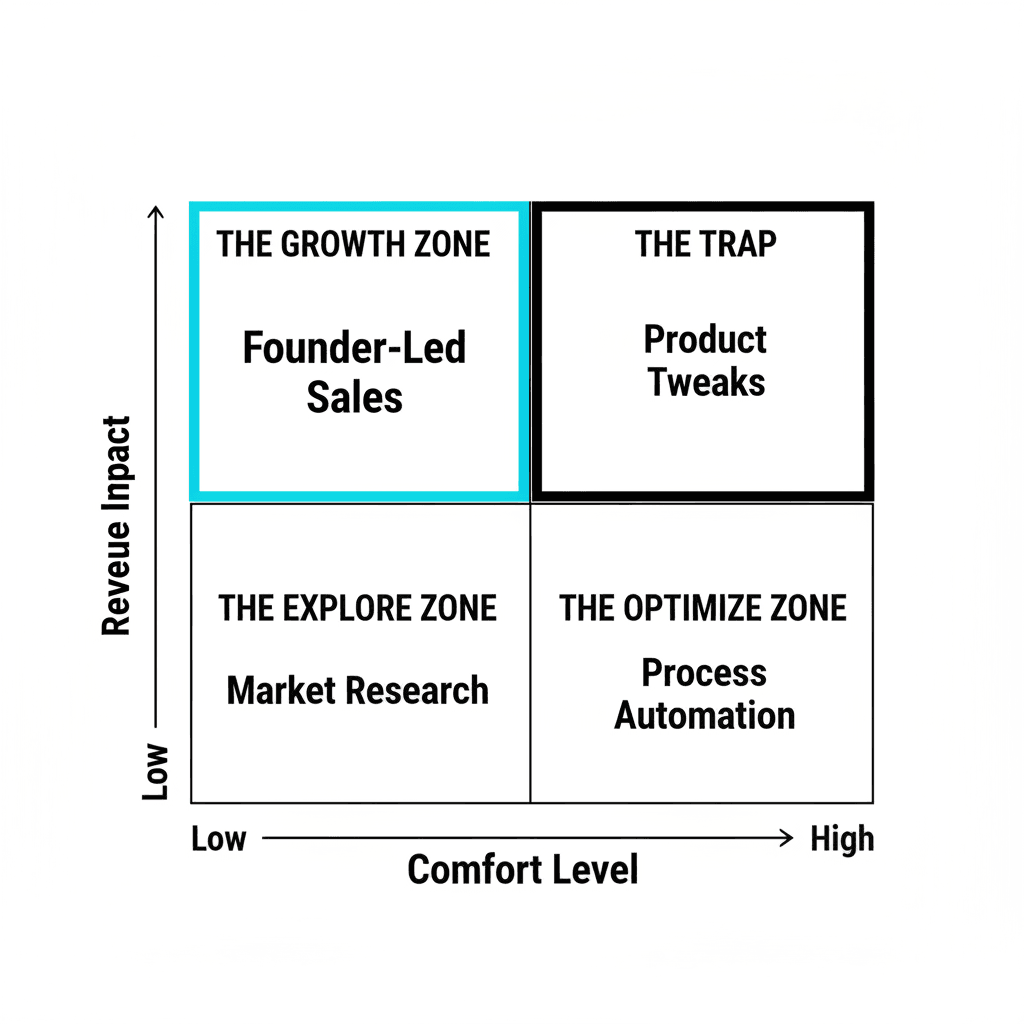

For early-stage B2B SaaS founders under $200k ARR, success isn't about copying big-tech playbooks, but replacing a frantic "task list" with a focused, founder-led strategy

Sitting in your spare bedroom doing cold outreach will move the needle more than tweaking your pitch deck ever will

If I had a dollar for every time an early-stage B2B SaaS founder told me, "I should have known better with GTM," I wouldn’t be writing this article.

Crikey, I’d be running a fund.

But I’m not running a fund. I’m talking to Australian founders every week who have built incredible technical products but are staring at a flat revenue graph. If you are a B2B SaaS founder sitting somewhere between pre-revenue and $200k ARR, this is written specifically for you.

The problem isn't usually the product. The problem is that a lot of you are using American-style GTM playbooks you found on Twitter or LinkedIn.

Or worse, you have no strategy at all—just a frantic attempt to copy what the big players like Salesforce or Atlassian are doing, forgetting that those companies are playing a completely different sport.

You have built what looks like a strategy, but in reality, it’s just a task list. And it’s burning your runway.

The "Fake GTM" Plan Most Founders Copy

When I look under the hood of a stalled startup, the "GTM plan" usually looks suspiciously identical. It’s a collection of activities that feels like work but results in zero traction.

It looks like this:

- Hire a salesperson: Usually a junior BDR, handed no process, no clear Ideal Customer Profile (ICP), and told to "go find leads."

- Post on LinkedIn: Generic thought leadership with no positioning that sets you apart from the other 47 startups in your niche.

- Run Google Ads: Driving expensive traffic to a homepage that lists technical features rather than business outcomes.

- Go to conferences: Collecting 50 business cards, having three awkward coffees, and closing nothing.

- "Do more SEO": Writing blog posts for keywords that no one is searching for yet.

- Enter awards: Spending precious hours applying for "Innovation of the Year" instead of calling customers.

Nice. You have ticked a lot of boxes. But what you have built is a task list designed for a Series B company with $5 million in funding selling to a total addressable market of 50,000.

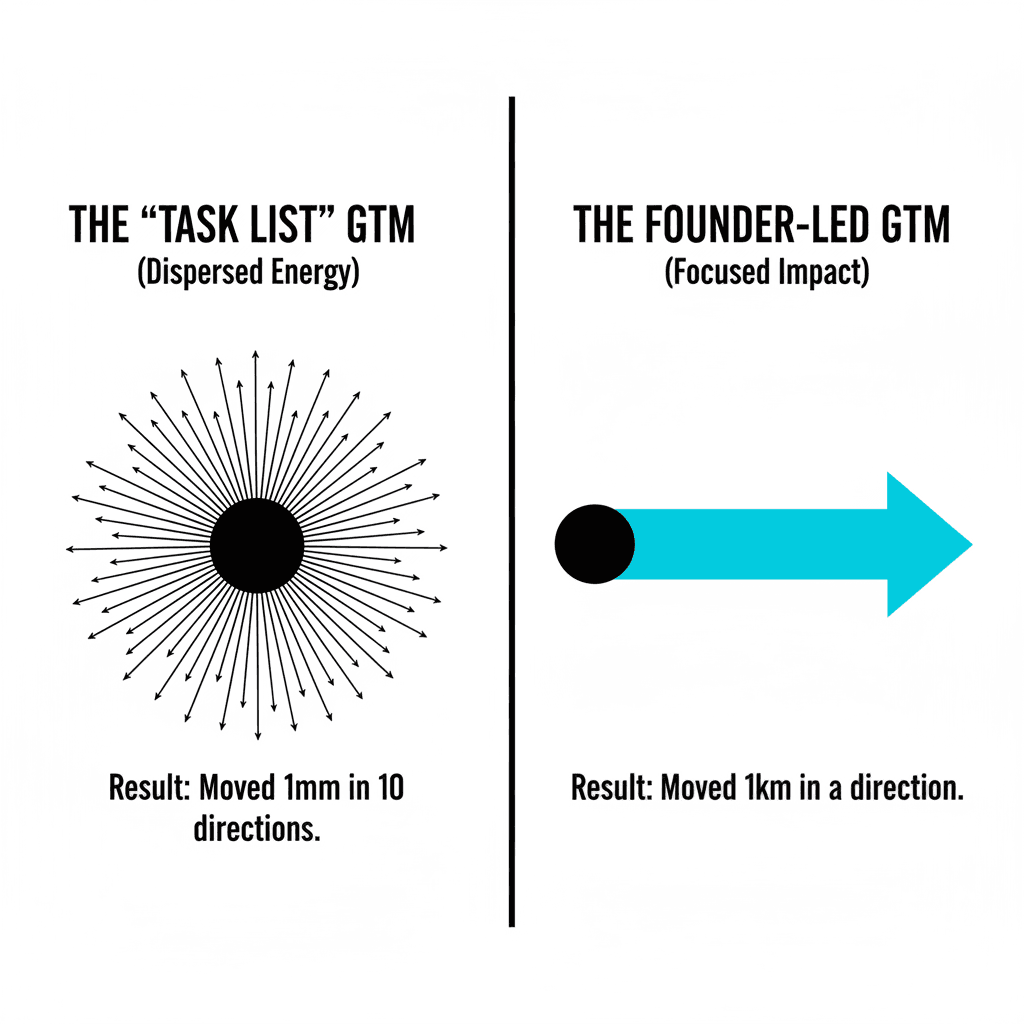

The Task List vs. Real Strategy

How do you know if you are running a task list or a strategy?

| The "Task List" GTM | The Real Early-Stage Strategy |

|---|---|

| Focuses on activity volume (number of posts, ads run). | Focuses on conversion mechanics (conversations to demos). |

| Tries to be everywhere (LinkedIn, TikTok, SEO, Ads). | Dominates one channel where the buyer lives. |

| Message is broad to "capture the market." | Message is narrow to disqualify the wrong fit. |

| Outsources sales to a hire or agency. | Founder-led sales is the primary engine. |

| Relies on vibes and hope. | Relies on math and ratios. |

If you are reading this and thinking, "Yep, that’s me," don't panic. You are in good company. But you need to stop, because this approach ends in one of two ways: running out of cash, or burnout.

What Actually Matters Under $200k ARR

After 18 years working on B2B deals in industries as tough as mining and hospitality, I can tell you that "brand awareness" doesn't pay the server bills in the early days.

If you are under $200k ARR, you don't need a complex matrix. You need traction. Here are the only six pillars that actually count toward getting those first 10 to 20 logos.

1. A Ruthless ICP

Most founders define their ICP (Ideal Customer Profile) loosely: "We sell to HR managers at mid-market companies."

That is not an ICP; that is a prayer.

You need to name the exact person and company type most likely to say yes in the next 90 days. You are looking for the first 10 to 20 logos you would bet your remaining runway on.

The Check: Can you find the specific individuals on LinkedIn by name? If your definition is too broad to build a list of 100 exact humans, your ICP is too vague.

2. A Vivid Problem Story

If your buyer cannot see themselves in your story, they will not buy. Your website and pitch deck shouldn't be a list of features; they should be a mirror reflecting their current pain.

You need a few clear use cases that describe:

- The specific pain they feel right now.

- What changes in their daily workflow.

- What life looks like after your product.

The Scenario: Instead of saying, "We offer automated rostering software," say, "We stop you from spending your Sunday night texting casual staff to fill Monday morning shifts."

3. A Simple Offer

Confusion is the enemy of conversion. Early-stage founders often present a giant menu of options: seven pricing tiers, enterprise customisation, and a promise that "we can build whatever you need."

Stop it. You need one clear entry offer and price.

Make it incredibly obvious what they get, what it costs, and how to start. Always solve for the customer's ability to make a decision, not your desire to cover every edge case.

The Check: Can a prospect understand exactly what they are buying and how much it costs within 10 seconds of looking at your pricing page?

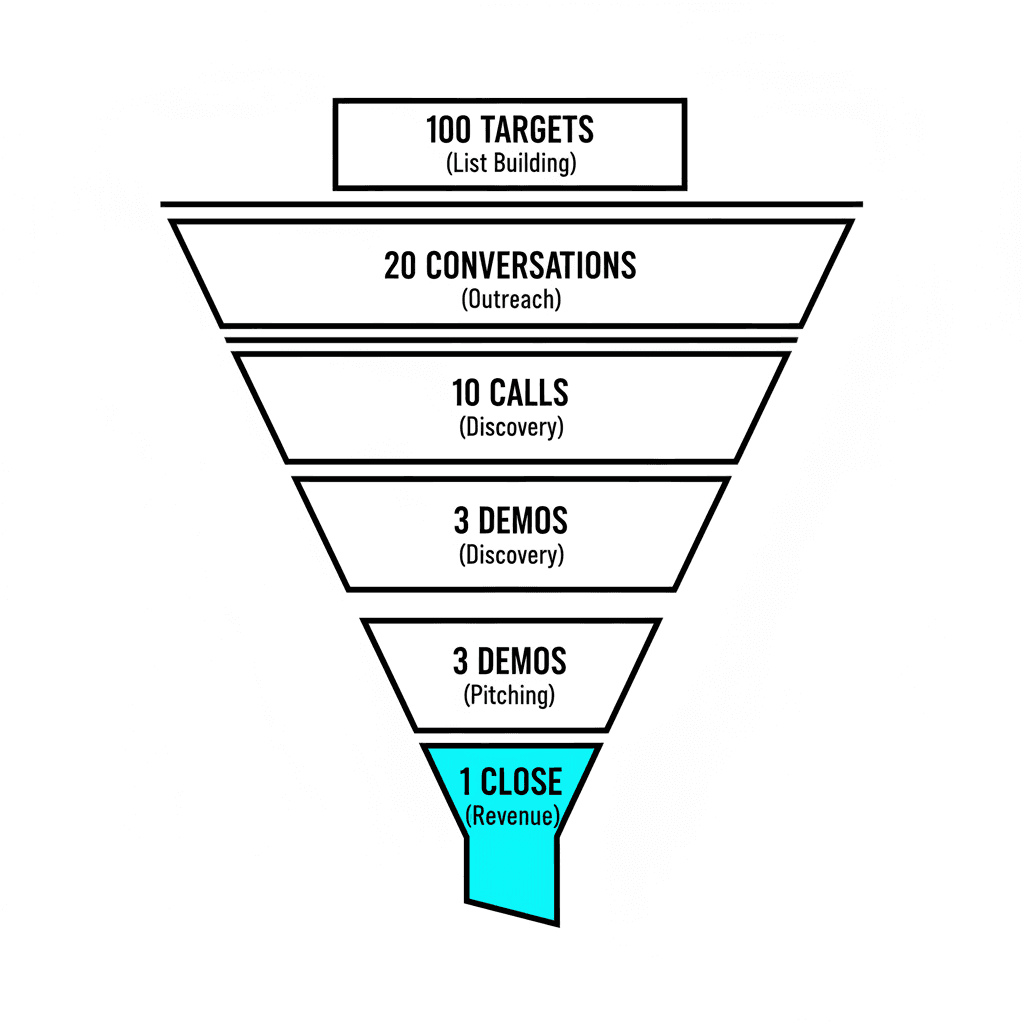

4. A Founder-Led Path

This is the math part. You need a simple, repeatable path from contact to close. You cannot optimize what you do not measure.

A healthy early-stage funnel might look like this:

If you don’t know your own numbers, you aren't running a GTM process. You are running on vibes.

5. Early Proof

Your first few buyers are taking a risk on you. Your job is to de-risk that decision.

You don't need Forrester Wave reports. You need:

- Before-and-after stories.

- Real usage data.

- A simple ROI example (e.g., "This saves 12 hours a week").

This is what makes the next 10 buyers feel safe enough to sign the contract.

6. Channels That Match Your Buyer

Don't try to "be everywhere." That is advice for Coca-Cola, not a SaaS startup with three employees.

Pick channels based on where your buyer actually pays attention. If you are selling to site managers in construction, they probably aren't reading long-form threads on X (Twitter). They might be on LinkedIn, or they might need a phone call.

It is infinitely better to own one channel deeply than to spread yourself thin across five.

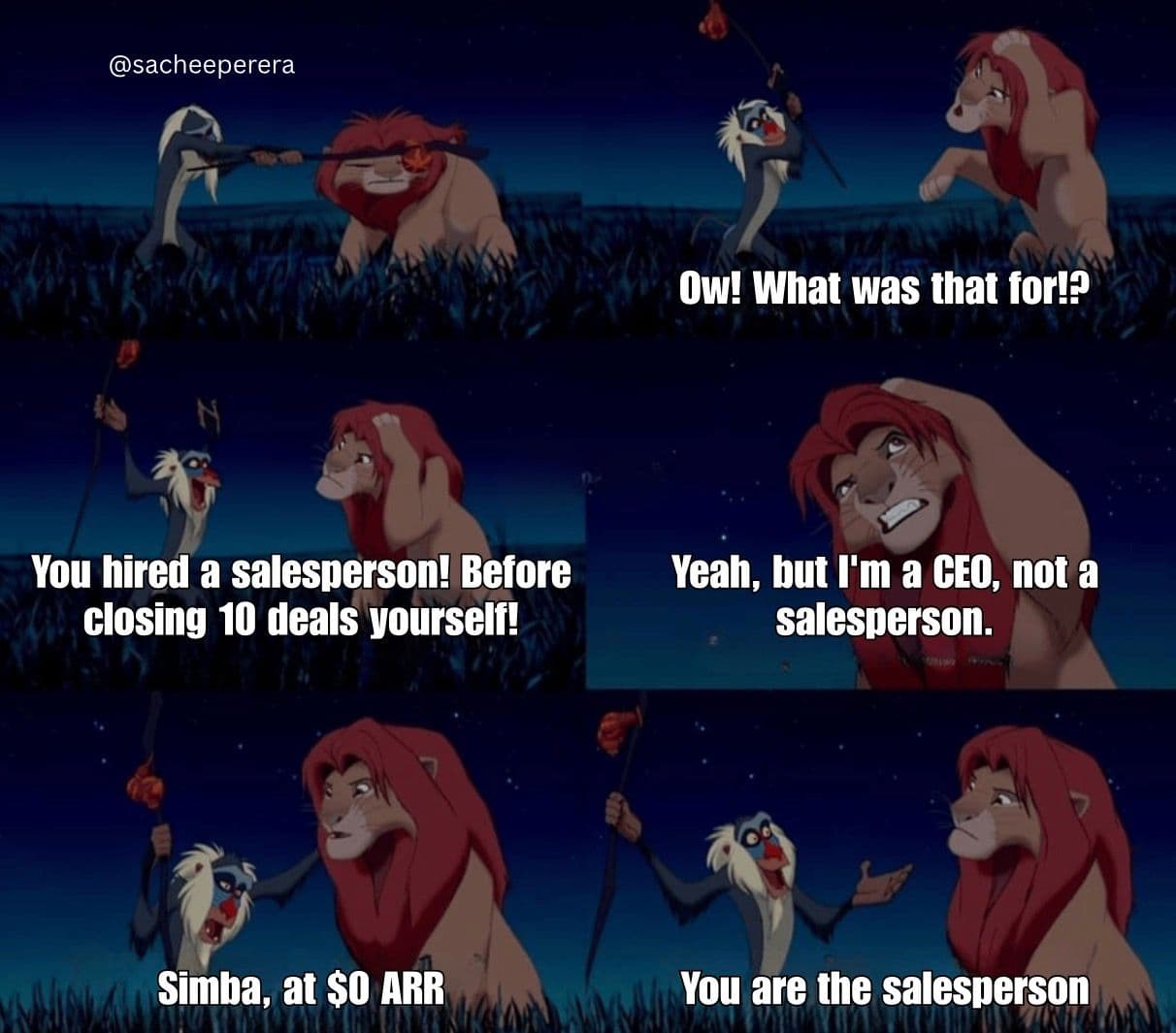

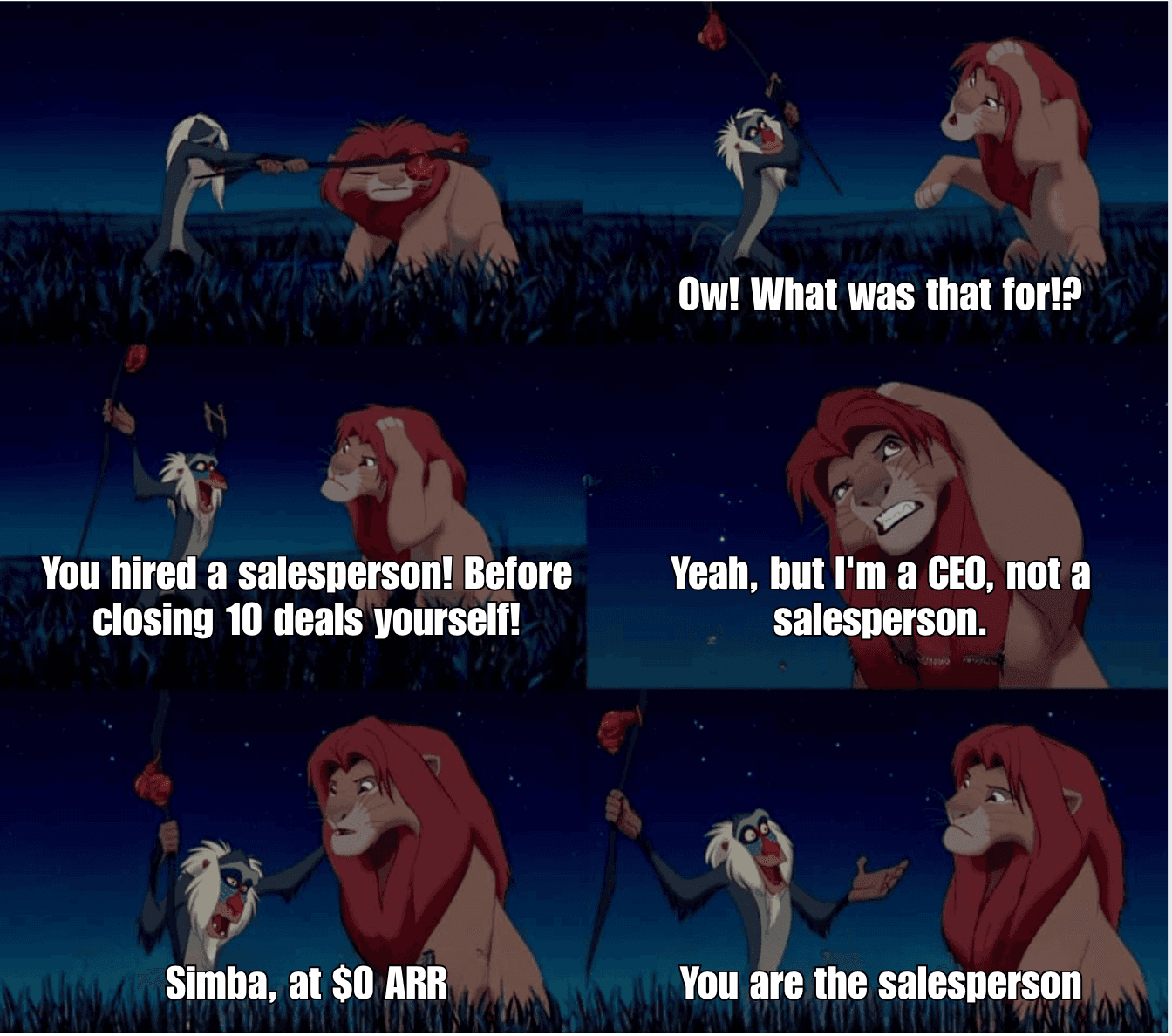

What Happens When You Ignore This

I recently spoke with a founder—let's call him Dave. Dave had a great technical product in the logistics space. He spent six months and $40,000 trying to "scale."

He hired a junior sales rep because he "didn't like sales." He ran LinkedIn ads because he saw a competitor doing it. He spent weeks tweaking the UI because "if the product is good enough, they will come."

The result? 47 LinkedIn comments, 2 lukewarm demos, and zero new revenue.

This is the "hiding in product" trap.

- The founder stays in "we are still building" mode because shipping features feels like progress.

- Sales feels uncomfortable, so it gets outsourced or delayed.

- "Product Market Fit" is treated like a magical event they hope to discover from behind a laptop.

Dave burned months of runway wondering why his "growth strategy" wasn't working. The reality was, he didn't have a strategy. He had a task list of distractions.

Your Real Job as a Founder

Here is the facts: You do not need a salesperson. You need to be the salesperson.

At the early stage, your only unfair advantage is you. No BDR can tell the story with your passion. No agency understands the nuance of the problem like you do.

You don't need Google Ads; you need 100 targeted conversations initiated by you. You don't need awards; you need referenceable customers.

Your job is to get out of the code, talk to customers, do the outreach, and get rejected. Sitting in your spare bedroom doing cold outreach or fielding objections on Zoom will move the needle more than tweaking your pitch deck ever will.

Hoping that a Series A funding round will create headlines and solve GTM for you is a fantasy. You know what creates headlines? Running out of cash because you tried to scale a disjointed task list.

If This Feels Uncomfortably Familiar

If you read this and thought, "Crikey, that is me," you are exactly who I work with.

I run a short GTM Health Check specifically for early-stage Aussie B2B SaaS founders ranging from pre-revenue up to around $200k ARR.

We stop the "random acts of GTM." We look at your ICP, your story, and your math. We turn that frantic task list into a focused strategy that actually brings in revenue.

If you want to stop guessing and start closing, reach out and ask me about the GTM health check.

Subscribe to get more insights

Weekly insights on B2B SaaS GTM strategy, founder-led sales, and scaling from $0 to $1M ARR.