The stupidly simple strategy framework

Most founders confuse complexity with strategy. If you can't explain it in 5 minutes, you don't have a strategy.. you have diddly-squat

Most founders confuse complexity with strategy. If you can't explain it in 5 minutes, you don't have a strategy.. you have diddly-squat

Most people treat strategy like its a uni assignment.

They focus on word count over substance...churning out a 50-page doc, complex diagrams, and words like 'synergy' as a security blanket to mask the fact that they don't actually know what to do.

But the thing is If you can't explain your strategy to succinctly in under 3 minutes, you don't have a strategy.

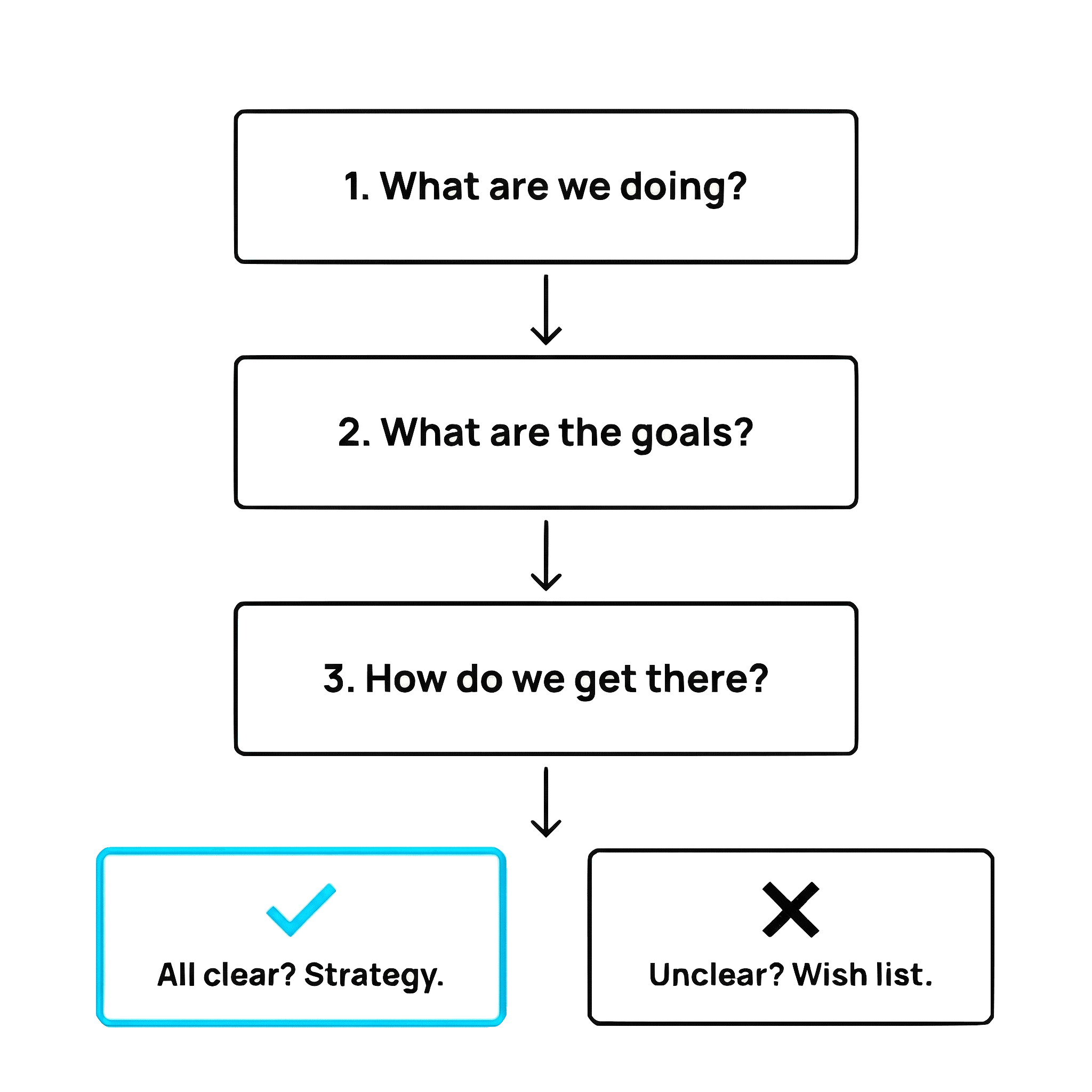

The 3-Question Test

So how do you know if you actually have a strategy?

Ask yourself or better, ask your team these three questions:

- What are we doing?

- What are the goals?

- How do we get there?

You can apply this to your business strategy, a marketing plan or even just how to win your first 5-10 customers.

If everyone can answer all three clearly and consistently, you have a strategy. If they can't, or if the answers vary wildly, you have a wish list. No amount of PowerPoint slides will fix that.

So what is strategy, really?

Strategy is simply just a boring plan and your case for why you'll win using this plan. It's not a wish list or a forecast; it's a clear, linear case for how you'll reshape the market in your favour.

...

That's it 🤷♂️

What bad strategy looks like

Before we look at how to write it, let's be honest about what bad strategy looks like. Most of what gets called "strategy" is just corporate noise.

1. The "Dog's Breakfast" "We will increase revenue by 20%, launch 3 new features, and grow the team to 15 people."

That is not a strategy. That is a wish list. It tells you what you want, but not how to get there or why it will happen.

2. The "Vomit" The 50-slide deck. It has a SWOT analysis, a PESTLE analysis, and three different types of quadrants.

If you can't memorize it, you can't execute it. Complexity is often where bad strategy goes to hide. Don't get me wrong, all these things are important but it is not THE strategy; these are tools you use to develop the strategy.

3. The "Buzzword Salad" "We will leverage AI-driven technologies to disrupt the paradigm and deliver best-in-class solutions."

This means nothing. If you can swap your company name with a competitor's and the sentence still makes sense, you don't have a strategy.

4. The "Layer Cake" "We're going to have the best product AND the best price AND the best service."

If you're not saying "no" to something, you're not making a choice. And strategy is choosing. The companies that try to be everything to everyone end up being nothing to anyone.

5. The "X for Y" (The Copy-Paste)*

We're going to be the Uber for Dog Walking" or "We'll just do what Atlassian did."

I saw this all the time after I left Uber. Founders would pitch me: "We're going to do UberEATS, but better. A more local flavor. A different model for drivers."

You can't copy-paste a strategy from a different market or a different decade. Strategy is specific to your context. What worked for Uber in 2015 might kill you in 2025.

The Ultimate Test: If you deleted your strategy document tomorrow, would anyone do anything differently on Monday? If the answer is "no," it's not a strategy. You have... a tragedy (sorry lol, I couldn't resist)

The Framework

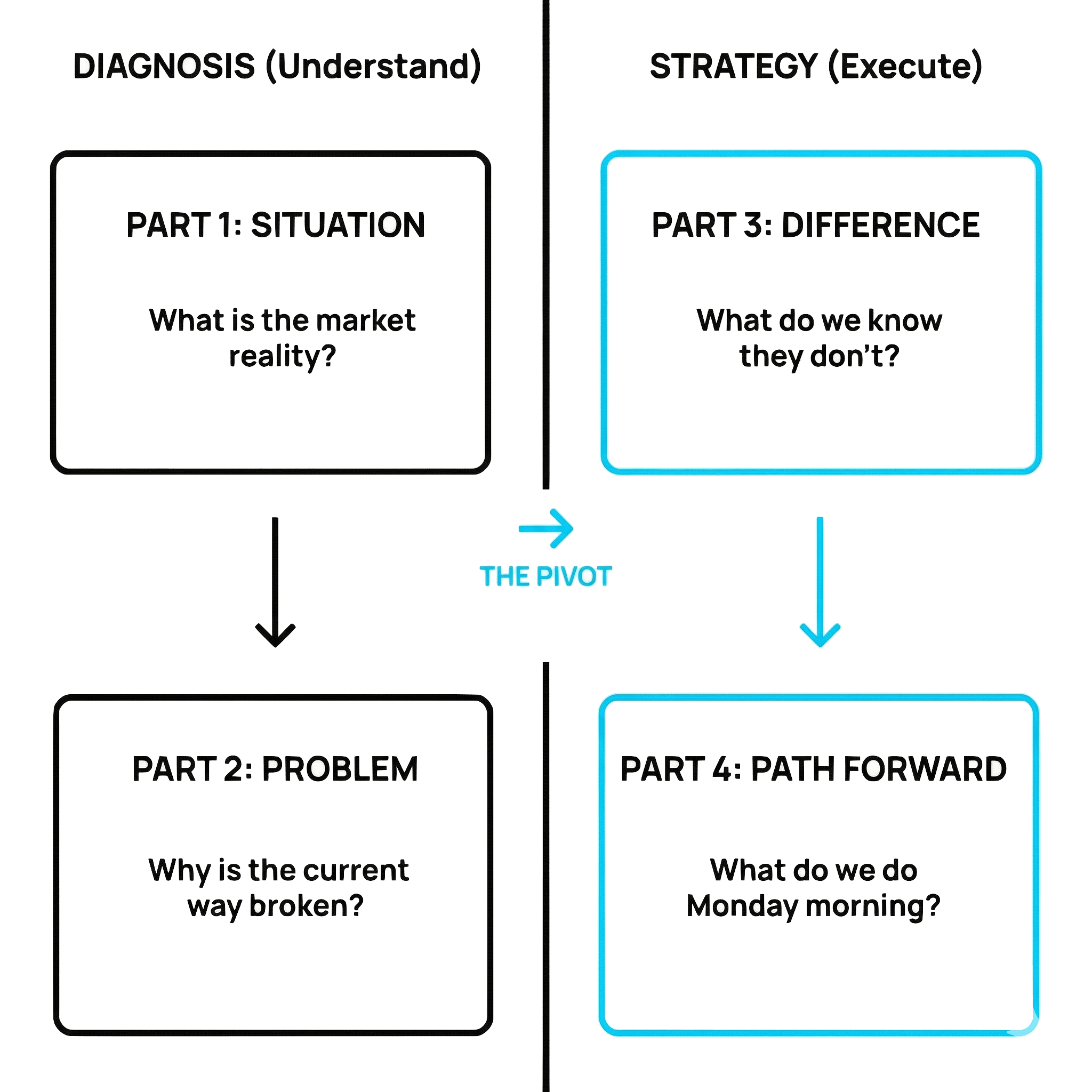

Over the years, I've codified how I think about strategy into 4 parts. But here's what most people overlook: strategy has two distinct phases. And you're a bit like a doctor that diagnoses you before you prescribe medicine or a treatment.

Phase 1: Diagnosis (Understand the problem) Parts 1-2. You diagnose the market's illness before you prescribe the cure.

Phase 2: Strategy (Build your answer) Parts 3-4. You find your unique insight and turn it into action.

Most founders skip Phase 1 entirely. They jump straight to solutions without understanding the problem. That's not strategy. That's guessing.

The Core Philosophy:

- Strategy is found, not created. You don't invent it in a boardroom; you find it by diagnosing the market. You talk to customers until you find the pattern that everyone else has missed.

- Complexity is a mask. If a strategy requires a 40-slide deck to explain, it's usually hiding a lack of focus.

- Diagnosis before Prescription. We must diagnose the market's illness (the problem) before we prescribe the cure (your product).

Here's how it works:

Part 1: The situation (the status quo)

What is the market reality?

This isn’t about you. It’s about the world your customer lives in. What is the standard operating procedure right now? We’re looking for the "industry standard" that everyone accepts as normal.

The Validation: Would a room full of your target customers nod in agreement if you read this out? If they argue, you haven’t captured the reality.

Part 2: The problem (the pain)

Why is the current way unsustainable?

Here we diagnose the disease. Why is the industry standard failing? This isn't a minor annoyance; we are looking for a systemic failure.

In the SPICED framework, this maps to Pain and Impact. What is the specific cost of staying with the status quo?

The Validation: Is this problem acute and widespread? Does it represent a "broken state" of the market?

THE PIVOT: From Diagnosis to Strategy

Parts 1-2 were about understanding the problem. Now we shift to building your unique answer. This is where most strategies fail. They either skip the diagnosis entirely, or they diagnose correctly but then follow the same playbook as everyone else.

The next two parts are where you earn the right to win.

Part 3: The difference (the zag)

What does everyone else get wrong?

This is the pivot point. You've diagnosed the problem (Parts 1-2). Now you need the insight that everyone else is missing.

This is the "Secret" that explains why the problem persists.

Most of your competitors will "Zig" (follow the consensus). You must "Zag" (expose the flaw in that consensus).

This is about being right about something the rest of the market is wrong about.

A real difference requires a trade-off. If you aren't saying "No" to something, you don't have a strategy.

The Structure: "The market thinks the answer is X, but we know the answer is actually Y."

(When I say "Zig" and "Zag," I'm referencing the teaching style of Ziggy, Zig Ziglar, not Marley.)

Part 4: The path forward (the action plan)

The Sequence

Strategy is useless if it doesn’t dictate what we do on Monday morning. This section outlines the chronological sequence of moves to reshape the market reality.

The Validation: Does this explicitly deprioritise other good ideas? (Remember: Strategy is sacrifice).

Real life worked examples

Now let's see how Diagnosis → Strategy works in practice.

Example 1: Mining Software

Here's how this framework applies to CorePlan. This is where I took the business thorough a pivot from Springtech to a pure SaaS play transforming the business and the industry to adopt and use modern SaaS - starting small then going large. Notice how Parts 1-2 (diagnosis) set up the insight in Part 3, which then unlocks the action plan in Part 4.

Phase 1: Diagnosis

Part 1: Situation Mining companies have always struggled to get timely, accurate information about their drilling operations. Progress updates from the field took days or weeks, delays that made it impossible to make agile decisions or stay on budget. Meanwhile, the drilling contractors (the crews actually doing the work) were using paper forms, WhatsApp, and disjointed legacy systems, left largely out of the digital transformation conversation.

Every software vendor was building for the miners, hoping to force contractors to log into mining-focused solutions. But on the ground, these tools were ignored or only half-used. The actual data producers, drillers, were underserved and unhappy.

Part 2: Problem Because the contractors weren't truly bought in or enabled, miners had little or no real-time understanding of where their money was going. Drilling costs could spiral, with issues and delays only surfacing weeks later. There was constant friction between drillers and mining companies; each blaming the other for mistakes, overspending, or mishaps. The industry accepted this as a "necessary evil" of exploration, but it created mistrust, wasted millions, and slowed down projects.

Phase 2: Strategy

Now I had the diagnosis. Time to find the insight.

Part 3: The Difference (The Zag) Everyone thought the problem was a mining company problem, so they built for miners. We realised you can’t solve the miner’s data problem without first solving the driller’s workflow. Our insight: serve the contractor first, make drilling crew workflows seamless, intuitive, and valuable for them. If you win the driller, you unlock the data for everyone.

In other words, the market thought the answer was forcing contractors to use mining systems; we saw the answer was building a solution that drillers actually wanted to use. By empowering contractors, miners would finally get the data and transparency they needed. i.e the concept I talk about called Save the cheerleader save the world!

Part 4: The Path Forward

- Focus on drillers. Design software that maps naturally onto drilling crews' daily routines: mobile-first, simple, and fast. Collect data once, at the source.

- Build contractor-first value. Give contractors tools to manage productivity, automate admin work, and cut out the paperwork so they become advocates.

- Connect stakeholders. Seamlessly feed real-time operational data back to both contractors and mining company teams, breaking down the "us vs them" divide.

- Graduate to the platform. Once contractors are truly onboard, roll out dashboards and analytics for miners, finally delivering live, trusted drill progress and cost data at a glance.

See the difference? We didn't start by pushing software top-down to the mining companies. We found the hidden constraint (underserved drill contractors) and solved for them. That's what unlocked real-time visibility and changed how exploration drilling is run.

Example 2: Hospitality Staffing Platform

Sometimes strategy isn't about building a new product. It's about finding a new story for a different room.

Here is exactly how we launched Sidekicker in Western Australia when I was the General Manager ("first boots on ground").

Phase 1: Diagnosis

Part 1: Situation

Sidekicker started in Melbourne. Over there, the hospitality industry was addicted to temp agencies. The playbook was simple: "We are a digital, better, cheaper temp agency." But Perth? Different beast.

In WA, mid-market venues hated temp agencies. They saw them as expensive, low-quality last resorts you only called if the stadium was full or you were truly desperate. The standard move for a Perth pub was to manage their own casual pool. If I walked in pitching "better temp staffing," I would have been solving a problem nobody thought they had.

Part 2: Problem

But while they didn't use agencies, WA venues were drowning in a different problem: Talent Volatility. WA is cyclical. Huge summer peaks, dead quiet winters. Plus, it runs on backpackers. A venue would build a killer team, and three months later, half of them would vanish to pick fruit or travel north. Venues were stuck on a hamster wheel of recruiting, training, and losing staff. They couldn't keep a roster together for the peak season to save their lives.

Phase 2: Strategy

Part 3: The Difference (The Zag)

The East Coast strategy was: "Replace the Temp Agency." My WA strategy was: "Augment the Internal Roster."

The Insight: I realised I couldn't sell "on-demand staff" to people who hated temp agencies. So I pitched Sidekicker as Blended Workforce Technology, an already established angle Tom and Sam were using but sparcingly because of the lack of need in eastern states.

I didn't tell them to fire their staff. I told them to build a "Second Layer" a pre-vetted, pre-familiar extended bench they could access instantly. It wasn't about filling a panic shift; it was about stabilising their business against the WA churn.

Part 4: The Path Forward

- High Quality Supply: WA had high unemployment for transient workers, so we had a flood of applicants. We did the opposite of "growth at all costs." I put up a velvet rope. We made the interview process brutally hard. By ruthlessly curating the talent, we ensured that a skeptical venue’s first shift was flawless.

- **Go Big or Go Home with Demand: **I ignored the "long tail" of small cafes. I focused entirely on securing "Founding Partnerships" with the big, iconic venues. These anchors gave us the volume to keep our high-quality talent happy and working.

- **The "Second Layer" Rollout: **We taught these venues to roster their core team first, then use Sidekicker to manage the peaks. We weren't the emergency button; we were the overflow valve.

Most people think "Strategy" is copy-pasting what worked in one city to another. If I had done that, we would have failed. The product was the same. The market reality was completely different. And that meant the strategy had to change.

Example 3: Sachee's Own Advisory

To show you I’m not just making this up, here is the exact strategy I wrote for my own advisory practice before I launched.

Phase 1: Diagnosis Part 1: Situation

We have a massive wave of first-time founders entering the arena. Some are technical wizards, others are deep subject matter experts, and some are sales veterans. But they all share a common blind spot: they view a startup through the single lens of their expertise. The coder thinks code wins; the salesperson thinks closing wins.

To fill the gaps, they rely on low-fidelity information—generic blog posts, ChatGPT, or "advisors" who are just sales trainers in disguise and have never actually built a company from scratch. They try to assemble a business by following generic "scale-up" advice for a "start-up" problem.

Part 2: Problem

This leads to the "Frankenstein" approach. A lot of founders just go and hire an experienced salesperson—or worse, a junior BDR (because they're cheap!)—hoping they'll just "figure it out." Or they pivot to "doubling down on social" or "going Product-Led Growth" without any real strategy.

They start burning cash on agencies and random advisors, and it's all downhill from there. They get stuck in the "Death Valley" between 1M ARR. They burn through their runway without ever finding true Product-Market Fit or a repeatable revenue engine. They don't fail because the idea was bad; they fail because they tried to delegate the hard work of company-building to people who didn't care as much as they did (or simply didn't know how).

Phase 2: Strategy

Part 3: The Difference (The Zag)

The market tells you to hire a 'Specialist- like a Head of Sales, a Growth Hacker, or a Fractional CMO to fix this. But a junior BDR can't build a strategy, and a 'Growth' agency can't fix a product problem. I realised that specialisation is fatal at the early stage. You don't need a silo; you need a system."

My Insight: I bring the pattern recognition of a Seed Executive who has scaled businesses across Mining, Media, Hospitality, and Marketplaces. I know that B2B wins often come from B2C principles (Customer Success and Support) and that "Enterprise Sales" is useless without the Marketing air-cover to support it. The market sells "advice." I offer an integrated architecture connecting the dots between Product, Sales, and Fundraising that most founders miss.

Part 4: The Path Forward

- Be startup friendly: For early-stage (under 200k ARR), I work on a fractional basis to professionalize the engine.

- Deploy the 'Full Stack' Engine: Instead of hiring a junior BDR to "figure it out," I'll help you install a comprehensive framework covering Enterprise/Mid-market sales, Marketing, Customer Success, and Support. I leverage my background in high-volume B2C and complex B2B to build a revenue engine that actually works.

- Prepare for Capital: Revenue is oxygen, but capital is fuel. Having led a $3.2M round myself, I guide the fundraising strategy—crafting the pitch, selecting the right investors, and navigating the diligence process so we don't just raise money, we raise smart money.

- Build to hand it over. Once the engine is humming, together we hire and train your full-time leadership team to take the keys and drive what we built.

Why this works for early-stage ($0-1M)

When you are between 1M ARR, you cannot out-spend the incumbents. You can only out-think them.

- Resource Scarcity: You can’t fix everything. This framework forces you to choose the one problem that matters (Part 2).

- No Brand: You have no reputation yet. Your only leverage is a superior insight (Part 3).

- Focus: You have limited time. You need a ruthless sequence of events, not a wish list (Part 4).

Strategy doesn’t need to be a 50-slide deck. It just needs to be true, clear, and actionable.

What's next

If this framework resonates and you want help applying it to your business, here are two options:

DIY: Grab a napkin. Write one paragraph for each of the 4 parts. Read it out loud. Test it with others and see what they say. If you have a team, can they all explain it back to you consistently?

Get a second pair of eyes: Book a GTM Health Check (free, 30 mins). I'll pressure-test your strategy and tell you where the gaps are.

Strategy isn't magic. It's clarity.

And clarity is the only thing that matters when you're trying to go from 0 to your first customers.

Subscribe to get more insights

Weekly insights on B2B SaaS GTM strategy, founder-led sales, and scaling from $0 to $1M ARR.